Privacy statement: Your privacy is very important to Us. Our company promises not to disclose your personal information to any external company with out your explicit permission.

![]() November 20, 2023

November 20, 2023

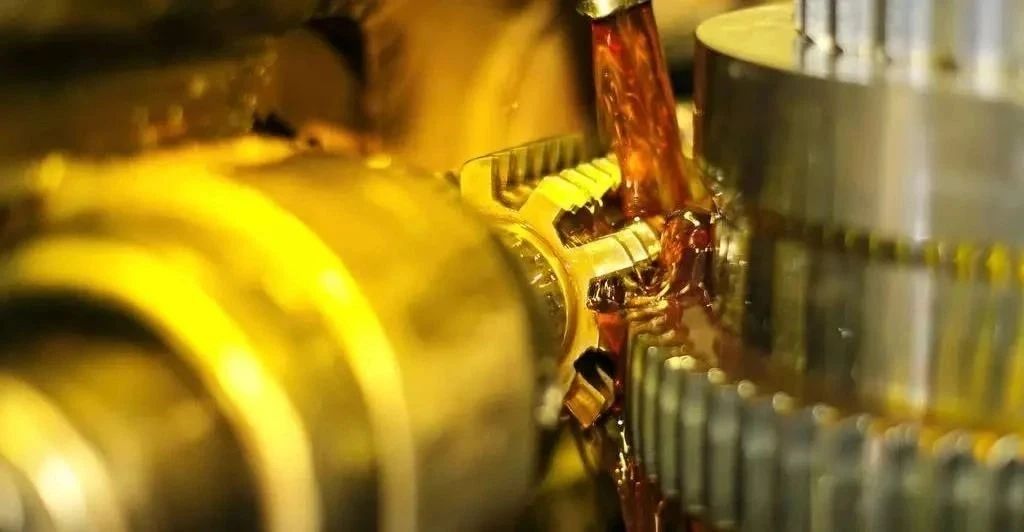

Entrepreneurial opportunities in the industrial lubricant industry!

Entrepreneurial opportunities in the industrial lubricant industry!

The above is the Entrepreneurial opportunities in the industrial lubricant industry! we have listed for you. You can submit the following form to obtain more industry information we provide for you.

You can visit our website or contact us, and we will provide the latest consultation and solutions

Send Inquiry

Most Popular

lastest New

Send Inquiry

Send Inquiry

Mr. James

Tel:0086-371-58651986

Fax:

Mobile Phone:+8613783582233

Email:sales@cn-lubricantadditive.com

Address:No.11 Changchun Road, High-Tech Zone, Zhengzhou, Henan

Related Products List

Mobile Site

Privacy statement: Your privacy is very important to Us. Our company promises not to disclose your personal information to any external company with out your explicit permission.

Fill in more information so that we can get in touch with you faster

Privacy statement: Your privacy is very important to Us. Our company promises not to disclose your personal information to any external company with out your explicit permission.